How to Pick Vacation Rental Accounting Software

Navigating the financial side of running vacation rentals can be tricky. It isn’t just about crunching numbers; it’s about ensuring the smooth running of your vacation rental business, whether you’re renting out a single beachfront cottage or juggling multiple urban apartments.

With vacation rental accounting software, the daunting tasks of tracking expenses, managing cash flow, and keeping up with multiple bank accounts become automated. This means less time spent on manual data entry and more time to focus on what really matters—providing an outstanding experience for your guests and growing your business.

In a nutshell, it’s about making your life easier. The software’s user-friendly dashboards and the ability to handle everything for you make financial management less of a headache. So we’ll be walking through some options to get you the perfect accounting software.

Why Vacation Rental Accounting Software?

Between tracking every dime of income from bookings to making sure you’re not spending too much on cleaning fees or falling foul of local regulations, it’s a lot. That’s exactly where vacation rental accounting software steps in. It takes all of that off your hands.

First off, it automates financial tasks. Imagine not having to manually track each payment or expense because the software’s got your back, reducing errors and saving precious time.

Then, there’s the real-time financial monitoring and reporting feature. This means you can see how your business is doing financially at any moment—information that’s gold when you’re trying to make smart, quick decisions.

Tax season is often a headache for many, but it doesn’t have to be. The software simplifies tax prep and compliance, organizing your financials in a way that makes sense come tax time and ensuring you’re playing by the rules.

And because no vacation rental operates in isolation, the software’s ability to integrate with other property management tools and platforms (like ours) is a game-changer. It means everything from bookings to bank accounts can talk to each other, streamlining operations and making life a lot easier.

In essence, accounting software manages all of the financials for you.

What to Look for in Accounting Software

So what should you be looking for? Here are the key features to look out for when you’re picking any kind of bookkeeping software:

- Comprehensive Expense Tracking and Categorization:

- Ability to record, track, and categorize all types of expenses related to your vacation rental business, such as cleaning fees, maintenance costs, and property management fees.

- Useful for detailed financial analysis and tax preparation.

- Income Management and Reservation Tracking:

- Tools to manage and monitor income from various sources, including direct bookings and online travel agencies.

- Features to track reservations, stay durations, and associated revenue for better forecasting.

- Integration Capabilities with Booking Platforms, Payment Gateways, and Other Property Management Software:

- Seamless integration with popular booking platforms (like Airbnb, Booking.com) and payment systems for efficient operations.

- Allows for automatic data synchronization to reduce manual data entry and errors.

- User-friendly Dashboard and Reporting Features:

- An intuitive dashboard that provides a quick overview of your business’s financial health.

- Comprehensive reporting tools for generating detailed financial reports, including income statements and cash flow reports.

- Scalability to Accommodate Business Growth:

- Software that can grow with your business, supporting more properties and increased transaction volume without a drop in performance.

- Features that support expanding operations, such as adding new properties or entering new markets.

- Security Features to Protect Financial Data:

- Strong security measures to protect sensitive financial data, including encryption and multi-factor authentication.

- Compliance with relevant data protection regulations to safeguard your business and your guests’ information.

- The Federal Trade Commission’s guide on Data Security offers essential tips.

Each of these features plays a vital role in the smooth operation and financial management of your vacation rental business, ensuring that you can focus on providing great experiences for your guests while maintaining control and insight into your business’s financial health.

5 Popular Vacation Rental Accounting Software Solutions

Property managers and vacation rental owners alike could benefit from having the right accounting software, so we’ve taken a look at 5 of the best accounting software offerings for vacation rental businesses on the market.

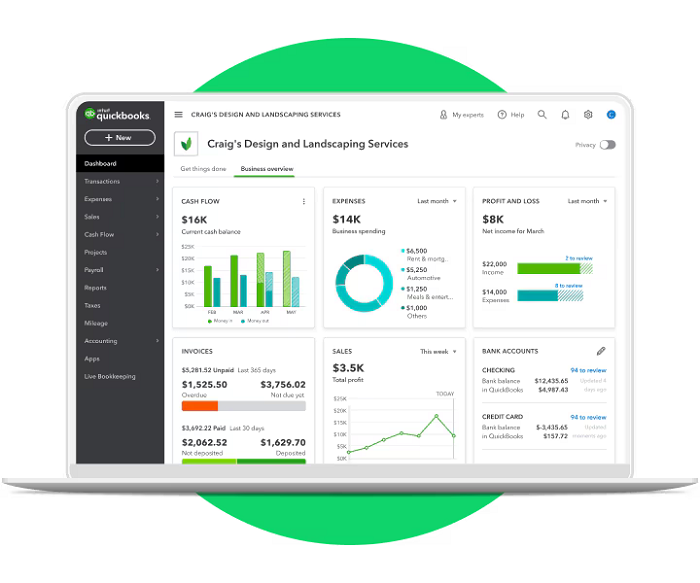

Quickbooks

Quickbooks is a household name when it comes to number crunching. Because of its extensive features when combined with Bnbtally, QuickBooks Online gets suggested to vacation rental owners often, especially for Vrbo and Airbnb.

For Airbnb hosts, it provides comprehensive invoicing, class tracking, and a customizable chart of accounts templates. QuickBooks Online is available for a free 30-day trial, with a monthly subscription fee of $30. The monthly fee for Bnbtally integration, which allows for up to two listings (Fit Small Business), is $32.

Pros

- Personalized class tracking and comprehensive invoicing for Airbnb.

- Provides a wide range of integrations and accounting features.

- For an additional charge, you can import historical data, guaranteeing thorough bookkeeping and financial reporting.

Cons

- It has a steeper learning curve in comparison to other options.

- The main platforms that Bnbtally integration supports are Airbnb and Vrbo, which limits its usefulness for hosts who use other platforms.

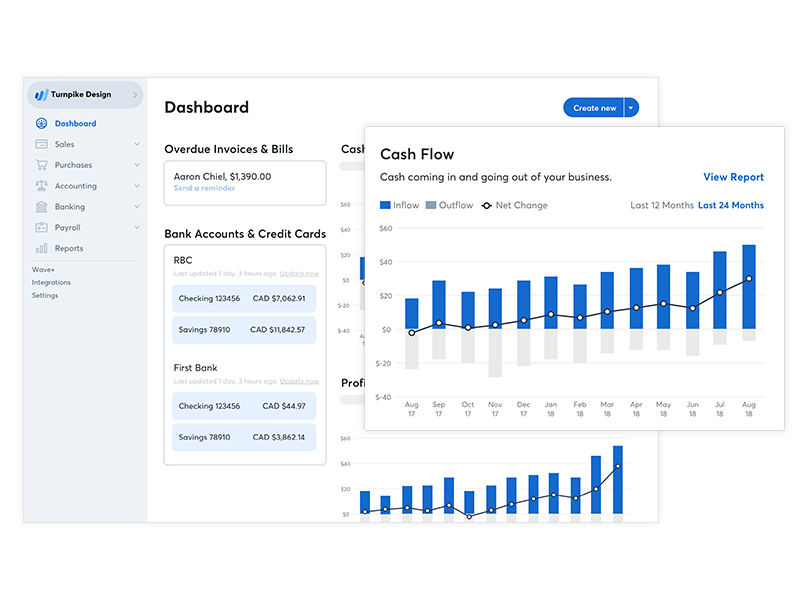

Wave

With its unlimited income and expense tracking, real-time updates for payroll, payments, and invoicing, and ease of use, Wave stands out as a fully free accounting software option. It’s perfect for smaller rental companies looking for simple fixes without having to pay extra fees.

Pros:

- Totally free

- Offers a plethora of features such as limitless tracking of income and expenses.

- It is ideal for smaller rental businesses or those new to accounting software because it is intuitive and easy to use.

Cons:

- Payroll and payment management features are not included in the free version, making it more basic than paid solutions.

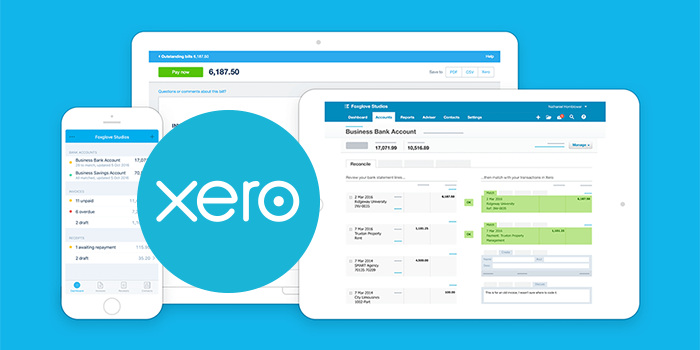

Xero

Because it supports multiple currencies and provides real-time bank connectivity, invoicing, expense tracking, and other features, Xero is a great option for Airbnb owners who have properties spread across different locations. Plans for Xero begin at $13 per month after a 30-day free trial.

Pros:

- Cloud-based and has bank connectivity in real-time, making financial tracking easier.

- Multi-currency support is perfect for properties located in different nations.

- Interface that is easy to use and integrated with a range of tools and applications.

Cons:

- Because of the monthly fees, it might not be as economical for people with simpler needs.

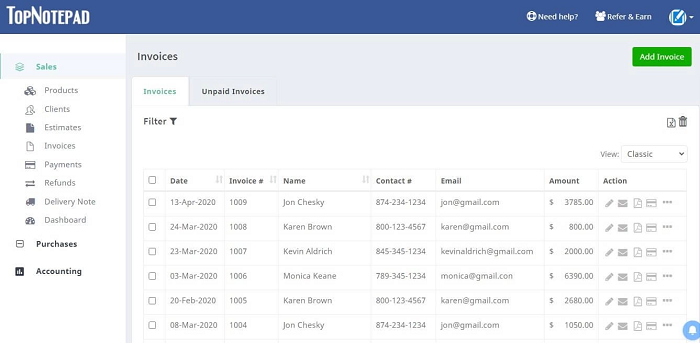

TopNotepad

With features like automated accounting procedures, online payments integration, and expense tracking, TopNotepad is renowned for its affordability and ease of use. There’s a free trial first, and there are annual plans starting at $34.72 for the Pond plan and $62.5 for the Lake plan.

Pros:

- Features like online payment integration and expense tracking make accounting tasks easier.

- Provides a simple, cost-effective solution with an easy-to-use dashboard for handling business finances.

Cons:

- Possibly lacking some advanced functions found in more feature-rich property management programs.

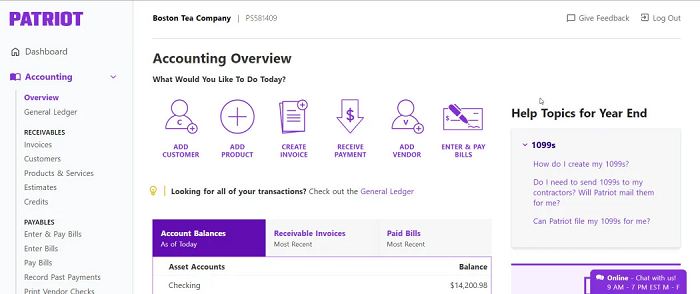

Patriot Accounting

With a $20 monthly basic plan and a $30 monthly premium plan, Patriot Accounting offers a reasonably priced solution. Although it’s said to have some bugs and a confusing interface, it offers features like automatic bank transaction imports, production and printing of 1099s and 1096s, and unlimited payments to vendors.

Pros:

- Features like automatic bank transaction imports and limitless payments to vendors make it an affordable option.

- Offers multifaceted accounting capabilities and complimentary professional assistance.

Cons:

- Customers have complained about a confusing user interface and slow customer service.

- Accounting errors and bugs are encountered by certain users, and certain services incur additional fees.

| Software | Pricing | User Experience | Scalability | Ease of Use |

| QuickBooks Online with Bnbtally Integration | QuickBooks: Starts at $30/month. Bnbtally: Starts at $32/month for the first two listings. | Highly detailed and comprehensive, suitable for detailed financial management. | High scalability with Bnbtally allowing for integration per listing, suitable for growth. |

Can be complex; steeper learning curve but highly efficient once mastered.

|

| Wave | Completely free, charges for payroll tax servicing and payment processing. | Highly favorable for ease of use and straightforward accounting needs. | Scalable for small to medium businesses, but might be limited for large operations due to simpler features. |

Very easy to use, making it ideal for beginners or small businesses.

|

| Xero | Starts at $13/month after a 30-day free trial. | User-friendly with a clean interface and integration capabilities with other tools. | Good scalability with multi-currency support and integration features. |

Considered easy to use with real-time updates and cloud-based access.

|

| TopNotepad | Free trial available. Plans start at $34.72/year for the Pond plan. | Simple and straightforward, focusing on essential accounting needs. | Suitable for individual hosts or small businesses, might lack advanced features for large-scale operations. |

Very easy, designed for users who prefer simplicity over complexity.

|

| Patriot Accounting | Basic: $20/month. Premium: $30/month. Offers a 30-day trial. | Some users find the interface confusing, and there have been reports of delayed support. | The feature set supports scalability, but interface and bug issues could hamper large-scale use. |

Mixed reviews on ease of use due to interface and customer support issues.

|

Is a PMS Enough?

Ideally you’d probably like to have one solution that can cover your general management tasks on top of financial reporting and management. This is possible with good property management software.

The extent of your property management activities and your unique requirements will determine whether a property management system (PMS) is adequate for your needs. With many features designed specifically for managing rental properties, a PMS can be extremely powerful.

But in some cases, particularly when it comes to intricate financial management, specialized accounting software might be more useful. This could include managing an expanding portfolio, preparing taxes, and producing thorough reports.

Final Thoughts

So to recap, as comprehensive as your vacation rental software may be, having a dedicated vacation rental accounting program might help you efficiently manage a lot more things. Generate invoices, calculate taxes, keep track of income and expenses, generate financial reports… The best accounting software for your vacation rental business will be robust enough to handle all of that and more.

Whether you’re a property manager or a short-term rental property owner, the right accounting software will make revenue management—and your life—a whole lot easier.

![Your Monthly iGMS Roundup [February 2020]](/content/images/size/w600/wordpress/2020/02/igms-roundup-feb-2020-cover.png)